WealthTech is the application of technology to support the wealth management industry. It can be considered as being part of the much broader umbrella term of FinTech.

In the context of this article I am considering WealthTech specifically as it relates to the offshore wealth management sector. This includes trust and fund administration companies and corporate services providers (CSP).

WealthTech, like all areas of technology, is rapidly changing. New apps, technology, and solutions are creating a surge of innovation to tackle the growing challenges faced by this somewhat niche, but growing, area of financial services.

In this article I consider where I believe the main areas of innovation will be in 2020.

#1. The growth of RegTech

RegTech is another subset of FinTech, which refers to technology to support compliance with regulation. Until recently, most regulation has been on a jurisdictional basis. This makes it very difficult to build technology solutions with any scale. In the offshore sector we are dealing with relatively small markets. Compliance professionals have not been well served by technology. They have had to make do with pulling information together using spreadsheets.

This is now changing, partly as a result of technology, but also because regulators are collaborating. We now see similar legislation across several jurisdictions e.g. CRS for tax reporting and Economic Substance regulation across the Crown Dependencies.

We will start to see a lot more providers offering RegTech solutions during 2020. I have already seen the larger technology providers such as Microgen / Touchstone start to work on ‘compliance hubs’ to offer a single point of entry for the compliance department.

There will also be more RegTech solutions appearing to solve specific regulatory challenges such as AML / KYC compliance. These will be adopted with support from the regulators who are becoming more flexible and supportive towards innovative technology solutions.

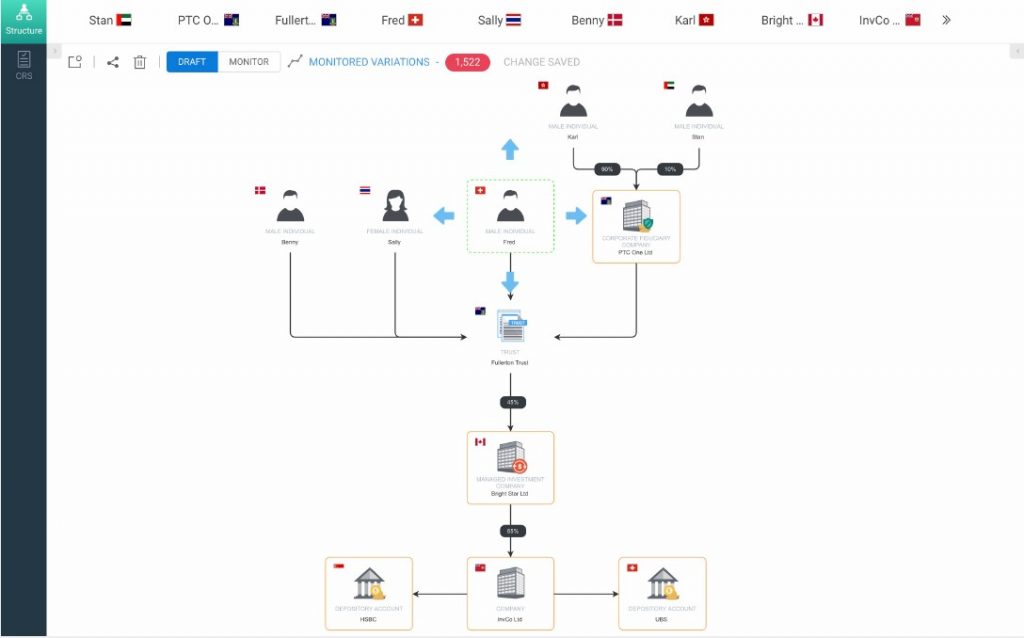

The sheer quantity of data being generated by firms is also going to necessitate RegTech to achieve compliance. A good example of this is CRS Expert from Centenal. Centenal provide tools for analysing data to comply with the new Mandatory Disclosure Rules.

Without RegTech it will be all but impossible for many firms to achieve compliance.

#2. Client web portals

Most CSPs and trust companies I have worked with over the last few years have talked about the need for portals for client access. Many share real concerns about what data can be shared between trustee and other parties. However, there is little disagreement about the benefits of digital collaboration between client and service provider.

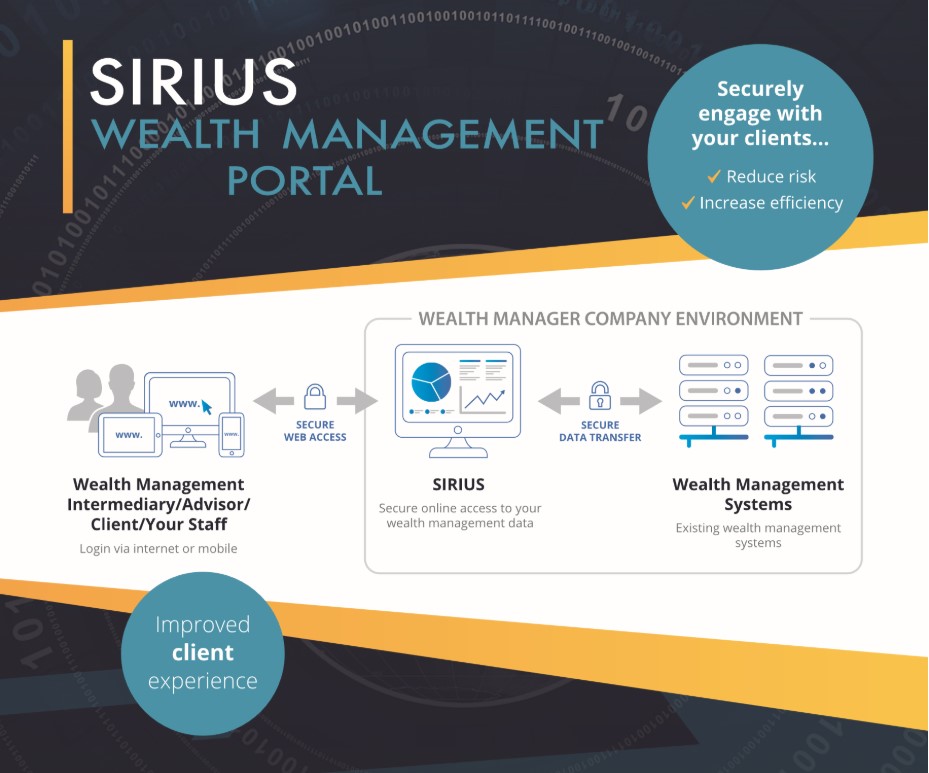

First generation web portals simply presented information from the back office system to the client. These portals are still useful in enabling the client to pull information when they want, rather than relying on end of period fixed reports, but this use is limited.

The latest generation of Client Web Portals, such as Sirius from Vega Solutions, are more interactive. They are designed for two way communication and true collaboration between client and service provider.

Customer demand is also on the increase. Today’s HNW and UHNW customers prefer to do business on-line. They expect to be able to access their information whenever they want, wherever they are.

This is going to push the requirement for secure client web portals up the priority list of CSPs. I now see portal functionality being categorised as ‘essential’ rather than ‘nice to have’. This is going to challenge many systems providers and IT managers over the coming years.

#3. Bots go mainstream

We have seen a lot of hype about Artificial Intelligence (AI) and machine learning in recent years. In the wealth management sector there are future opportunities here but I still think they are a fair way off.

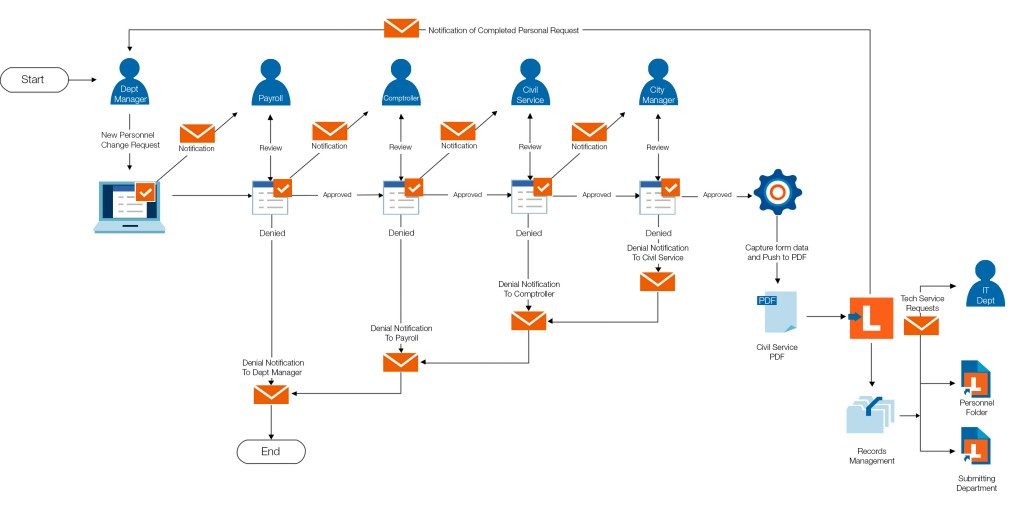

What we are likely to see more of is the use of ‘bots’ otherwise known as Robotic Process Automation (RPA). This is where a relatively simple piece of technology can replace repetitive human tasks. This is not about replacing humans with robots (which is what the AI hype continues to push), but the automation of mundane tasks to allow the humans to spend more time on added value tasks.

I still see a lot of legacy (10 year old+) systems being used by wealth management firms. These systems don’t integrate well with new technology which creates manual bottlenecks in business processes. RPA uses ‘screen scraping’ technology to either grab data from a legacy system to pump into a newer one, or to automate the input of data into a legacy data processing system.

RPA does have a limited shelf life and needs to be able to demonstrate very quick payback. This hasn’t been possible up to very recently, but there are now some very affordable RPA solutions available.

One example from a vendor I work with is Laserfiche. Laserfiche has invested in RPA to complement its existing business process automation (BPA) toolset. These two technologies are now in reach of even the smallest wealth management firm. A specific use case would be the Laserfiche Connector which can be used to extract information from legacy systems to feed into a Laserfiche business process. The guys at MBS in the Isle of Man are fast becoming experts at RPA and we are likely to see more applications of this and similar technologies over the year.

#4. Microservices

“Microservices – also known as the microservice architecture – is an architectural style that structures an application as a collection of services that are

- Highly maintainable and testable

- Loosely coupled

- Independently deployable

- Organized around business capabilities

- Owned by a small team

The microservice architecture enables the rapid, frequent and reliable delivery of large, complex applications. It also enables an organization to evolve its technology stack.” (Definition from microservices.io)

In the last 15 years we have seen the functionality of wealth management technology get ever more complicated as the technology tries to evolve to meet new regulation and customer demand. This has led to systems that can be challenging to implement and even harder to upgrade and maintain.

I am aware of many businesses that put off upgrading their core platform because they lack the resources to do proper regression testing. The result is they fail to get value from any improvements the vendor delivers.

One of the answers to this is a microservices architecture where an integrated system is broken down into more manageable components. Individual code units can be replaced or upgraded without impacting the rest of the solution.

I believe we are going to see much more of this type of system in the coming year.

This architecture is likely to extend into the business too. Organisations are more likely to opt for multiple integrated ‘best of breed’ systems, rather than implementing a single solution, that is good overall but likely to have compromises in some areas.

#5. Customer insights

My final prediction relies on organisations starting to realise the benefits of the massive amounts of data they collect, but fail to use.

RegTech solutions like CRS Expert are using this data to support compliance activities. However, there is a bigger opportunity to use data to gain greater knowledge of customer activity. We already see this in the consumer world with data-driven companies, like Amazon, using knowledge of their customers to generate increased sales.

Whether you agree with Amazon’s approach or not, they demonstrate what is possible with data analytics and machine learning.

I see this approach extending to the wealth management sector. However, it does assume that organisations will already have gone through several digital transformation iterations.

- Processes will need to be automated with process metrics being collected and stored

- Customer interactions through web portals will need to be tracked, and

- Transactional data will need to be tagged with customer metadata at all stages of a process

Once this data becomes available insight technology will start to be possible. This year we are likely to see systems that take advantage of this data.

In this blog I have taken a small area of the financial services industry and focused on the areas that I see most likely to develop in 2020. There are plenty more areas I could have picked on, but deliberately chose these five. If you have other ideas please feel free to share them in the comments section below, or contact me directly.

One Response

Thanks for a great tips, This would be a different idea from the routine tips. We specialise in finance, tax, IT, marketing, HR, Payroll & ESR Services. As an ISO 9001 certified company with over 30 years international experience in accounting, VAT and technology, we have the unique capabilities to ensure you are fully compliant to the UAE legislation. See our range of articles, white papers and learning resources and self-study material to learn accounting, VAT and taxation at your own pace