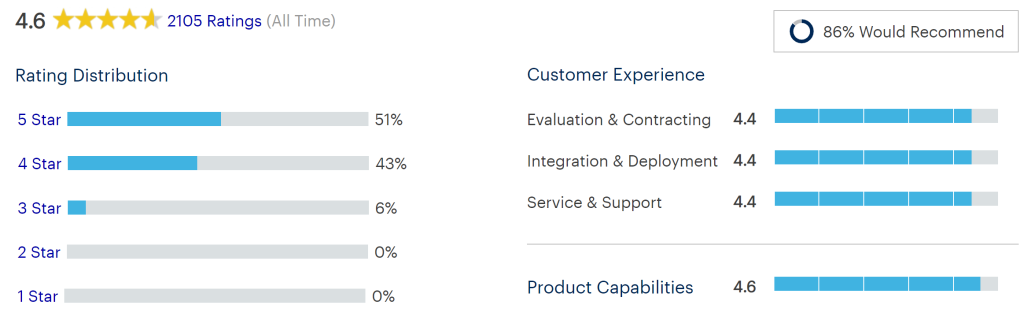

In this article I will provide details of the latest Gartner Peer Insights report, plus my own views on the content platforms that I come across most often in the International Trust and Corporate Services market; iManage, Laserfiche, M-Files, Microsoft and OpenText. Laserfiche has been selected as a Customers’ Choice for the third year in a row.

These are generally from providers who have focused on financial services or related industries. I am not suggesting that other systems aren’t suitable, just they don’t have significant presence in this market.

Gartner Peer Insights is a free peer review and ratings platform designed for enterprise software and services decision makers. Reviews go through a strict validation and moderation process in an effort to ensure they are authentic.

What Are Content Services Platforms?

Content services platforms (CSPs) are integrated platforms that provide content-focused services, repositories, APIs, solutions and business processing tools to support digital business and transformation. Typical CSP use cases include document management, back-office processes, business process applications, records management and team productivity.

A CSP has its own repository. CSP services and data may also integrate with external, non-native repositories and applications through prebuilt connectors, API development or prepackaged integrations. CSPs have web, desktop and mobile app interfaces that let users navigate through and work with the different content services.

The platforms may also offer prebuilt solutions for vertical and horizontal content processes, such as case management, legal matter management, contract management. CSPs are available on-premises, as hosted services, in the cloud (SaaS and/or PaaS) or in hybrid architectures that combine cloud and on-premises storage and/or services.

Voice of the Customer

In the CSP market, Gartner Peer Insights has published 1,956 reviews and ratings in the 18-month period ending 31 January 2022. Figure 1 shows all eligible vendors categorized into four quadrants based on User Interest and Adoption (X-axis) and Overall Rating (Y-axis). Within each quadrant, vendors are listed in alphabetical order.Vendors’ User Interest and Adoption scores incorporate three factors, each given one-third weight: review volume, user willingness to recommend, and review market coverage across industry, company size, and deployment region. A vendor must meet or exceed the market average User Interest and Adoption Score to qualify for the right-hand quadrants. The market average Overall Rating is the mean of all eligible vendors’ average Overall Ratings. Vendors must meet or exceed the market average Overall Rating to be positioned in the upper quadrants. For ease of understanding, each quadrant is labelled as described below.

Vendors placed in the upper-right quadrant of the “Voice of the Customer” quadrants are recognized with the Gartner Peer Insights “Customers’ Choice” distinction, denoted with a Customers’ Choice badge. The recognized vendors meet or exceed both the market average Overall Rating and the market average User Interest and Adoption.

Vendors placed in the lower-right “Established” quadrant of the “Voice of the Customer” meet or exceed the market average User Interest and Adoption but do not meet the market average Overall Rating.

Vendors placed in the upper-left “Strong Performer” quadrant of the “Voice of the Customer” meet or exceed the market average Overall Rating but do not meet the market average User Interest and Adoption.

Vendors placed in the lower-left “Aspiring” quadrant of the “Voice of the Customer” meet neither the market average User Interest and Adoption nor the market average Overall Rating. Like all vendors in this report, their products align to this market and they have met the minimum criteria to be included.

Laserfiche, M-Files and Microsoft are all vendors that should be familiar to readers of my blog. They are often considered by our clients in the trust and corporate services sector, with Laserfiche being one of the most popular choices for integrated document and content management.

Content Services Platforms Peer Reviews and Ratings

In addition to the synthesis provided by the “Voice of the Customer,” you can read individual reviews and ratings on Gartner Peer Insights by clicking here.

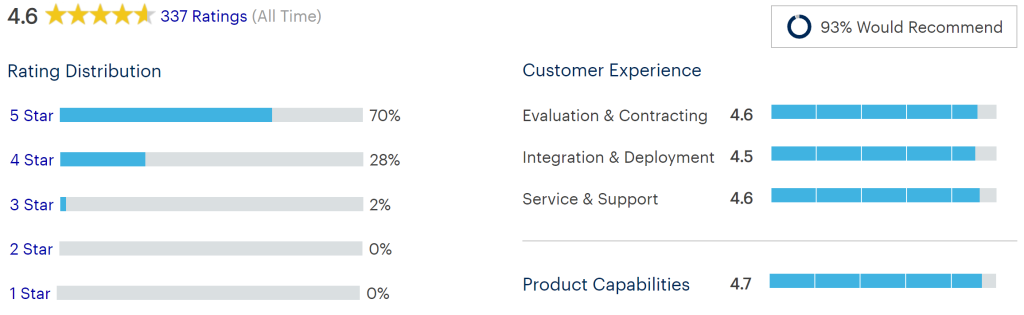

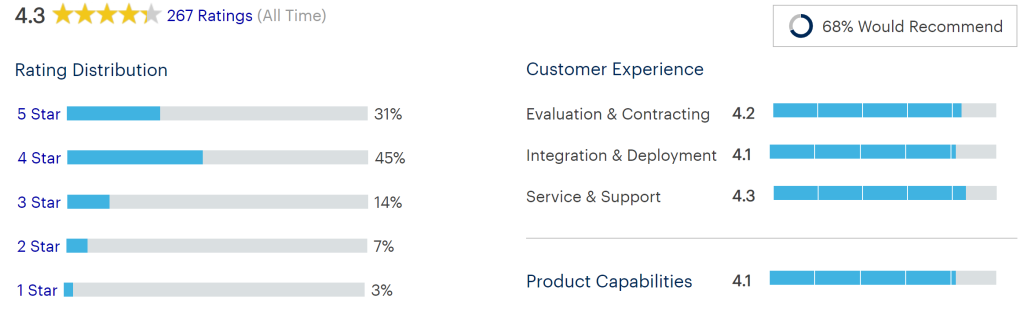

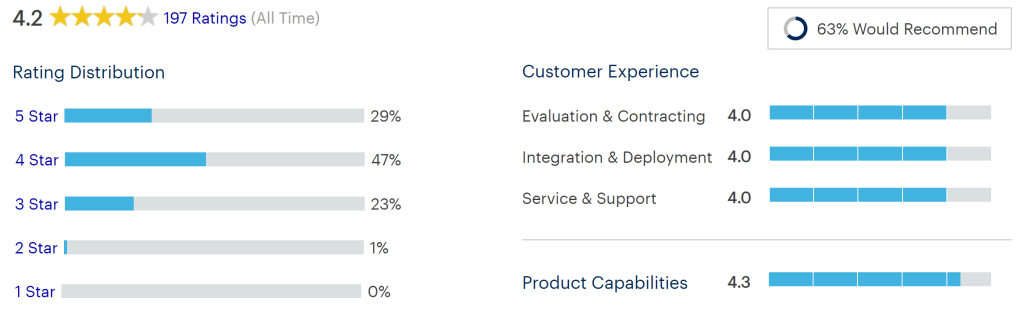

The remainder of this article will highlight some key insights for the CSP market based on 18 months of reviews, and will also point to particular ways to use the site in your buying process. Figure 2 summarizes the Overall Ratings (out of 5 stars) for vendors in the CSP market that have received more than 20 eligible reviews in the 18-month period ending on 31 January 2022, sorted alphabetically. The Overall Rating is a measure of how satisfied existing customers are with a vendor’s product.Figure 2. Gartner Peer Insights “Voice of the Customer” Content Services Platforms Overall Ratings

Source: Gartner (March 2022)

The move to Cloud

It is no great surprise that the systems that have performed well in this report are all either already fully cloud based as is the case with Microsoft Office 365, or they are aggressively developing their cloud and hybrid products. This is certainly the case with iManage, Laserfiche and M-Files.

What is more surprising is that international financial services businesses, who have traditionally been concerned about data jurisdiction, are also embracing cloud technologies. I have to admit I am surprised about how many businesses are now actively considering using public cloud platforms (e.g. Azure and AWS) and SaaS platforms to hold client documents. Don’t get me wrong, I am fully supportive of this move, but just didn’t expect to see it happening so soon.

With the vendors seeing many of their new and existing customers wanting cloud solutions this is clearly going to have an impact on the development of their traditional on-premise solutions. I am already seeing many vendors releasing new features into their cloud products first. Some of these features may trickle down to the self-hosted versions but it is taking time. I can see a position in the not too distant future when it will become very difficult to buy good content services platforms for self-hosted systems.

Selected Vendor Summaries

In this section, I am highlighting extracts from the Gartner report for the 5 vendors most commonly seen in the trust and corporate services sector.

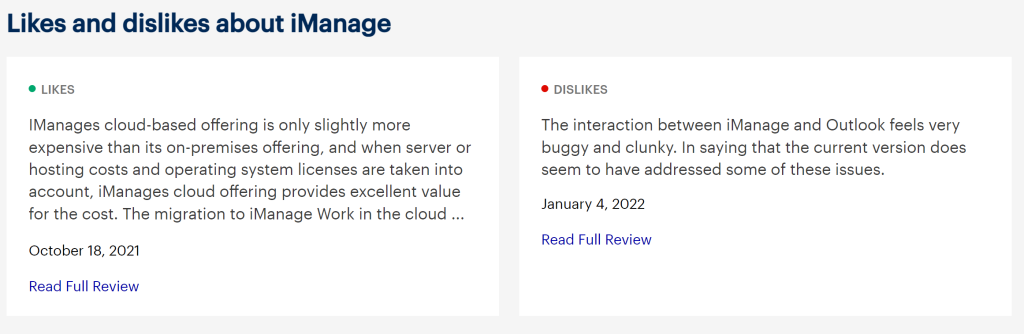

iManage

iManage is often seen as a niche vendor specifically for the legal sector. Whilst this is true globally, it is extremely popular in the trust and corporate services market, partly because many of these firms have spun out of the large offshore law firms.

iManage has been through a turbulent past with several changes of ownership. however the last management buy out over 5 years ago has given the company the stability it needed. It’s latest iteration of iManage Work is fully cloud enabled.

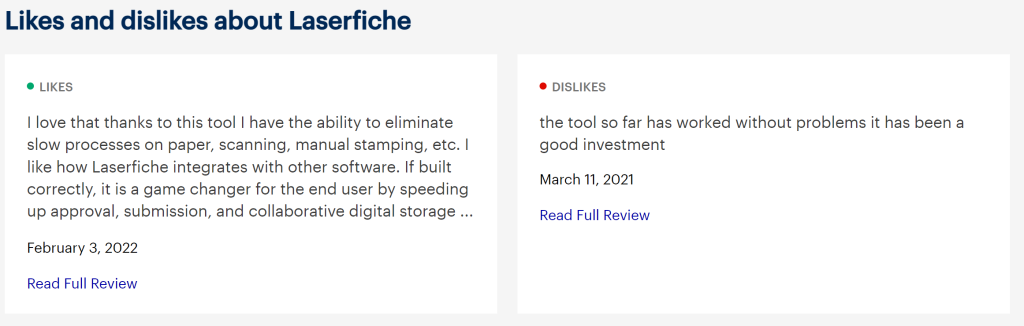

Laserfiche

Laserfiche is very popular in the US with particular strengths in financial services and local government. However, it’s markets outside the US are limited, mainly due to their small international sales team and lack of marketing. In Europe, Laserfiche is often described as the ‘best content management system you’ve never heard of’.

With cloud data centres in the UK and Europe now active, Laserfiche is clearly gearing up for growth outside the US. It remains a very popular system across trust and corporate services, largely due to the success of its resellers, particularly MBS in the Isle of Man.

M-Files

M-Files was founded in Finland in 2002 but is now present in over 100 countries, including the US where it now has its headquarters. Following the acquisition of a Canadian business in 2017 it started to develop its SaaS offering.

In the Channel Islands, M-Files is represented by Alternative Solutions Limited.

Microsoft

Microsoft and its 365 office automation suite needs no introduction and is commonly used by most businesses.

In terms of content services and document management the company has SharePoint which acts as the storage repository for all content created within the 365 platform. Some argue that SharePoint is not a ‘proper DMS’, which has some validity if you are trying to use SharePoint out of the box.

What SharePoint, and the other associated apps, does give you is a highly functional toolkit that will enable you to develop all the capability that is needed of a content services / document management platform.

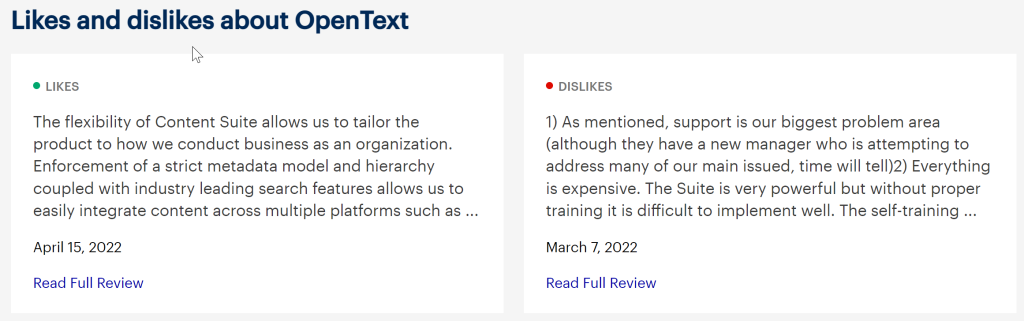

OpenText

I have included OpenText in this article purely for completeness. It is a vendor that is commonplace in the trust and corporate services sector, particularly in the Channel Islands. However, one must be careful when describing OpenText systems because there are at least 6 separate DMS that OpenText have purchased over the years and rebranded.

The one seen most in this sector is OpenText eDOCS, previously called Hummingbird. eDOCS was best known as a niche DMS for the legal sector (competing with iManage). eDOCS is not being actively developed as much as the other systems mentioned above and, as far as I am aware, it is not available as a cloud hosted SaaS solution.

What Is Gartner Peer Insights “Voice of the Customer”?

The “Voice of the Customer” is a document that synthesizes Gartner Peer Insights’ reviews into insights for IT decision makers. This aggregated peer perspective, along with the individual detailed reviews, is complementary to Gartner expert research and can play a key role in your buying process, as it focuses on direct peer experiences of implementing and operating a solution. In this document, only vendors with 20 or more eligible published reviews during the specified 18-month submission period are included. Reviews from end users of companies with less than $50M in revenue are excluded from this methodology. See the full “Voice of the Customer” methodology here.

Along with the historical peer-based perspective represented in this document, Gartner has a related expert-led Magic Quadrant for the CSP market. For related research in this market, please visit the Magic Quadrant for Content Services Platforms.