PlainSail, the Jersey based provider of trust and corporate services administration software has announced its integration with Verify by Tiller, an electronic identity verification (eIDV) tool.

In this article I am going to dive deeper into this integration, exploring additional aspects and implications for the trust and corporate services industry. For Jersey based businesses I will also include details of how this initiative supports the recently announced Jersey’s RegTech super-deduction scheme.

As the trust and corporate services industry evolves, innovative solutions become paramount. The recent integration between Verify and PlainSail, a rising star in the trust software landscape is a great example of this.

Verify by Tiller: A Closer Look

Firstly, let’s explore Verify, a robust digital solution for identity verification and compliance. Here’s what you need to know:

It speeds up ID checks by providing real-time remote identity verification and ID document capture. It also has global reach allowing you to verify the authenticity of ID documents from over 181 countries.

Key Features:

- Biometric Photo ID Matching: The product uses advanced algorithms to match a live photo of an individual against their ID document, enhancing security.

- International Name and Residential Address Validation: Cross-checks residential addresses against global databases, minimizing errors.

- Fraud Prevention: Layered security measures detect fraudulent users attempting to pass the identity verification process maliciously.

Business Benefits:

- Streamlined Onboarding: Simplify your Know Your Customer (KYC) processes by making it easier for clients to prove their identity quickly.

- Global Client Reach: Gain instant access to Tiller’s database of 1,900 government IDs from across 181 countries.

- Compliance Made Simple: Meet your ID-related compliance requirements securely and efficiently.

- Conversion Boost: Guide users through correct ID checks, reducing frustration caused by rejections.

- Compliance with JFSC: an independent review of verify by BDO concluded that Verify maps 100% to the JFSC handbook.

Why Tiller?

- Technology-First Approach: Tiller prioritizes innovation and technology, ensuring services stay ahead of industry trends.

- Growing Partner Ecosystem: Benefit from partnerships with third-party providers, including fintechs, data providers, and compliance systems.

- Quality Assurance: Tiller’s platform adheres to the highest compliance standards, with regular security testing.

- Product Innovation: Prebuilt components allow quick assembly of innovative offerings, reducing time-to-market.

- Accreditation: Verify is accredited by the ICAEW

Whilst this article focuses on the trust and corporate services sector, Verify was developed specifically for both regulated and supervised businesses, which is one of its key strengths. Tiller is committed to growing the number of countries it covers as well as increasing the coverage in the existing 53 supported countries. This gives it best-in-class international coverage.

Moreover, Verify’s eIDV empowers businesses to confidently verify identities while simplifying compliance processes. 🌟

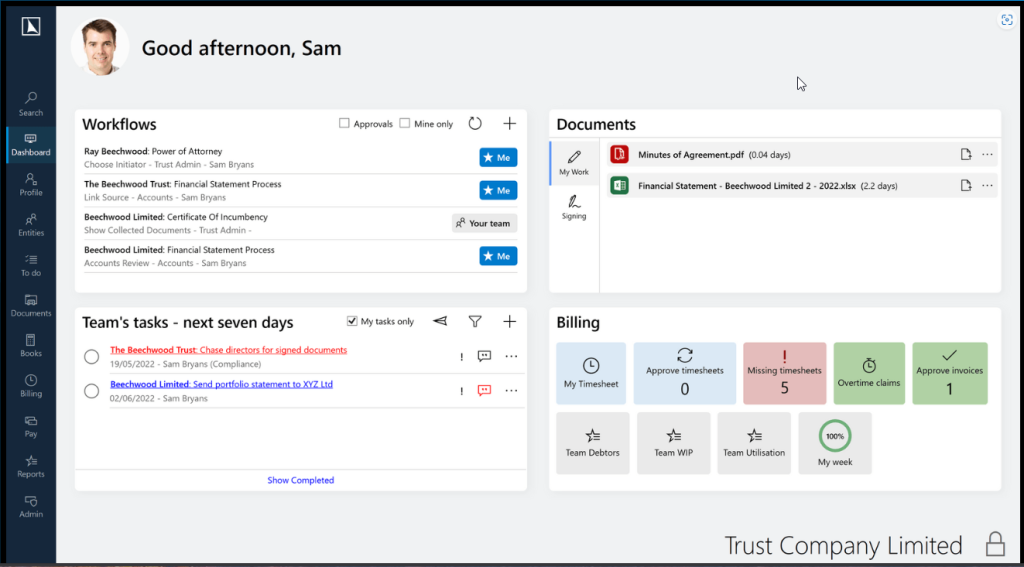

PlainSail: Navigating New Waters

PlainSail is now a well established challenger to the market leaders, particularly in the important market of the Channel Islands. With the rise of TrustQuay Viewpoint, the choice in the market has become more limited so it is great to see innovation and agility from PlainSail.

The PlainSail solution has consequently become the preferred solution for smaller trust companies and family offices. With a refreshingly modern user interface, PlainSail is backed by mature administration, accounting and compliance functionality. PlainSail has an established client-base, mostly in the Channel Islands and is no longer a risky choice for trust companies. However, I can see why larger trust companies are still put off by the small scale of its current operation.

PlainSail has always adopted a client-centric approach: they prioritise client needs, delivering tailored solutions for trust companies, fiduciaries, and financial institutions.

Based in Jersey, PlainSail understands the local landscape intimately. Therefore their proximity to Tiller Technology has provided a unique opportunity for collaboration.

The Integration: Unleashing Synergy

The recent announcement of the Tiller-PlainSail integration holds promise in the following areas:

- Enhanced Client Experience:

- By integrating Verify eIDV, PlainSail offers a seamless onboarding experience. Clients appreciate the speed and accuracy of identity verification, setting the stage for lasting relationships.

- Risk Management Advancements:

- Tiller’s PEP (Politically Exposed Persons) and sanctions checks empower PlainSail to mitigate risks. Identifying high-risk individuals and businesses becomes more efficient, safeguarding the trust sector.

- Data Integrity and Compliance:

- Regular data monitoring by Tiller ensures that PlainSail maintains accurate client information. Compliance officers can breathe easier knowing that data errors are minimized.

In addition, for Jersey based financial services provider, investing in Verify will be supporting by Revenue Jersey’s RegTech Super-Deduction scheme. This forward thinking incentive is designed to encourage local financial services providers to invest more in RegTech solutions. In fact, any technology spend that contributes to achieving compliance with the JFSC Handbook will be eligible for the super deduction.

From year of assessment 2024, eligible companies are able to deduct 150% of qualifying expenditures related to the purchase and implementation of RegTech in the year of acquisition. This enhanced allowance is offered to help companies automate the processes and controls required to navigate their regulatory obligations.

PlainSail’s integration with Verify definitely ticks this box and provides an added benefit in adopting this technology.

According to a recent event hosted by Digital Jersey, any expenditure on RegTech software is covered by the scheme. This includes capital investment, implementation costs, software licence fees and training. The solutions being claimed against are not restricted to Jersey based vendors either – although the focus of this article is clearly Verify and PlainSail, you are free to select whichever solutions best meet your requirements.

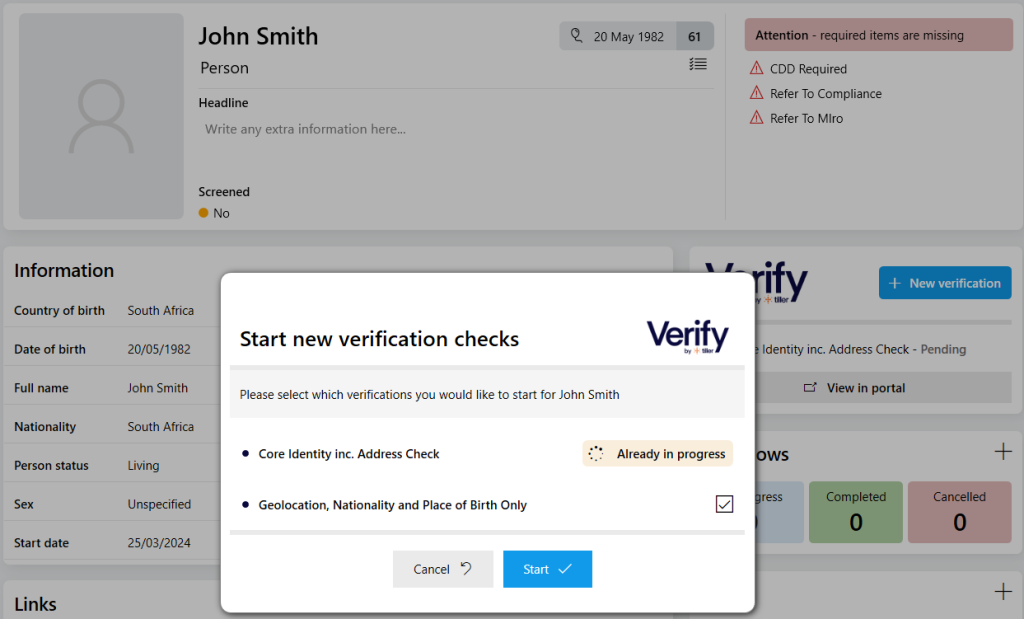

How it works

New verifications can be started, by clicking on “+ New Verification” button within PlainSail and selecting from the available mandates (the available list of mandates will be specific to each Tiller Client and forms part of the configuration screen in PlainSail).

Any verifications that are already “in progress” will be flagged, to prevent duplication.

Clicking on “Start” will create the selected application(s) in the Tiller Portal.

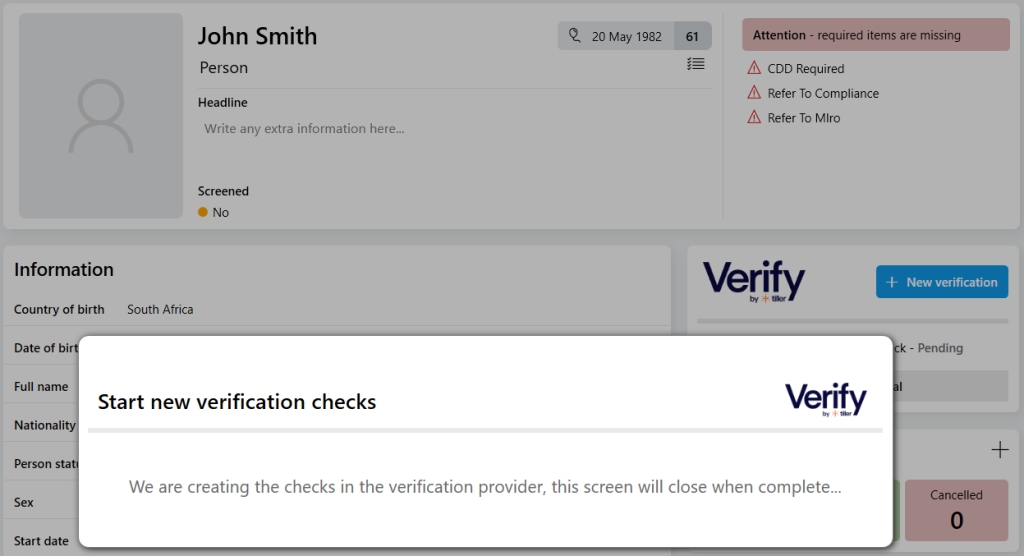

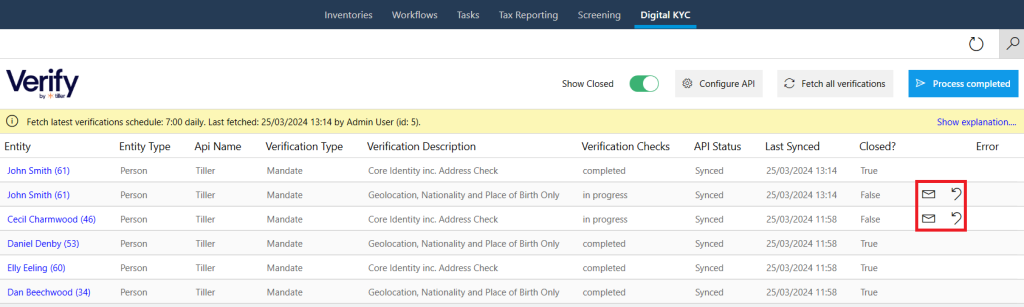

There is a central screen in PlainSail for keeping track of all the verification checks being done (or previously completed) via Tiller. This screen also contains buttons for resending the Tiller Verify email to the client or resetting the individual.

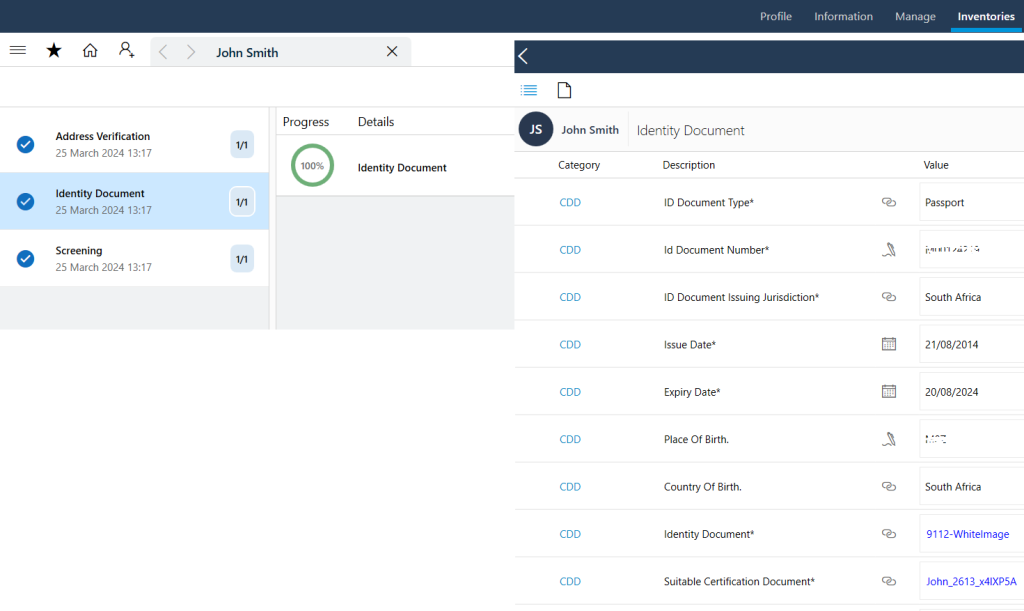

When an Identity Verification is completed, then the Identity document information and the Proof of Identity document (that was uploaded by the individual) is saved back to PlainSail. The full pdf Report generated by Tiller is also saved.

Looking Ahead

As a thought leader within the Trust Administration software space, I am always excited to learn about new developments like this one. Watch this space for updates, case studies, and success stories from PlainSail and the other providers who will certainly make this such an interesting sector to be involved in at the moment.

Remember, innovation often arises from unexpected partnerships, and PlainSail’s challenge to the status quo could lead to remarkable outcomes. Stay tuned! 🚀

Lastly, if you’d like an independent assessment of any of the solutions mentioned in this article please contact us. We can also provide you with project management and other technology advice and implementation services. Moreover, we are always happy to meet for a chat about your technology ambitions either face to face or over Teams – as long as coffee is involved!

Disclaimer: This blog post is for informational purposes only and does not constitute professional advice. Always consult with legal and financial experts regarding specific tax incentives and regulations.